Joelle Brunner

Every Swiss citizen has the right to obtain AHV (Alters- und Hinterlassenensversicherung) after retirement or an accident of a parent or the spouse. To be able to do that, all the working members of the population of Switzerland pay an amount of money to a fund each month. From there, retired people get their pension. Currently, there are a lot of working people and not as many retired people. So, there are no issues to get enough money for the system to work. But what will happen when our generation retires?

AHV – Explanation and History

The AHV is an obligatory insurance for everyone who works in Switzerland, including people with a domicile outside of Switzerland, and every person who lives in the country. The main idea behind the AHV is to make up for at least part of the loss of income due to retirement or an unforeseen death of a family member. This system was first accepted by Swiss voters in 1925 and then implemented on January 1st, 1948. In that year, the first pensions were paid. The concept is based on solidarity, meaning that part of the money in the funds is provided by the working people. The money is actually paid by the employer and is subtracted from the monthly income of the employee. The working people trust that future generations will do the same. Further than that, individuals who earn more pay more and with that support people with a lesser income. Other parts of the fund are provided by the economy, non-working insured people and the government. There is a fund with some money as a buffer for if during one year the AHV payments would be lower. But mainly the AHV spends around the amount of money that people pay per year (Informationsstelle AHV/IV, 2022).

So, with the concept of the insurance being developed in 1925, when the demography in Switzerland was characterized by a much shorter life expectancy than today, this presents some questions for the future of AHV and our generations retirement years.

Demography of Switzerland – Past, Current and Future

As of 2018, there were 8.5 million people living in Switzerland. This number is estimated to increase in the coming 30 years. For the population increase in Switzerland there are three different scenarios. Scenario A is the referential scenario, which assumes intermediate population growth until 2050 with an estimate of 10,4 million people living in Switzerland by then. Scenario B is the “high population growth” scenario, estimating 11,4 million citizens by 2050. And lastly scenario C is the lowest, with a predicted population size of 9,5 million by 2050 (BFS, 2021).

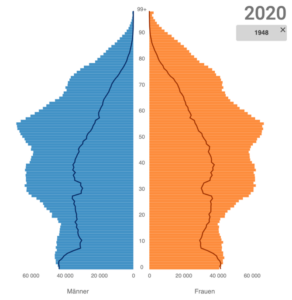

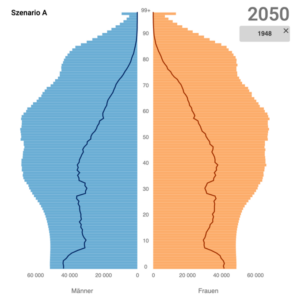

Looking at the demography curve of the Swiss population, the current shape resembles a fir, meaning there are already more old than young people. But the higher the age, the less people you have.

Fig. 1: Comparison between the demography curves of 1948, 2020 and 2050 (BFS, 2021)

Comparing the curve from 1948 to 2020, one can see that in 1948 the ratio between old and young differed a lot from nowadays. The birth rate was so high that the newborns outweighed every other age group. These were ideal conditions for establishing an insurance like AHV, which relies on future generations. Looking at the demography curve from 2020, the age group that most people are in are 25-45 years. Still, since this includes the biggest part of the working people, these are good terms for this insurance system. But when you take a look at the 2050 scenario, the average age will rise, and people tend to live longer. This ends in more people requiring pensions, whereas the working group stays more or less the same. If the trend continues, the AHV will struggle more and more to have enough money in their funds to pay the pensions of the then retiring people, who still paid their AHV contributions their whole working time (BFS, 2021).

The redistribution of the demography is due to the sinking birth rate, the low fertility, and the longer life expectancy (BFS, 2021). The life expectancy of people born in the year 2000 is 76.9 years for men and 82.6 years for women. These numbers increased to 81.0 years for men and 85.1 years for women born in 2020 (Bundesamt für Statistik, 2017).

Possible solutions and suggestions to ensure AHV in the future

To sum up, the difficulty of the future insurance of the elderly lies in making sure that the funds get enough money to pay everyone their monthly pensions, even though there will be less and less working people financing it. The most popularly suggested solution is that there should be funds that save up money now to use in the future. One way to finance that would be to raise the value-added tax and use the money generated from there. Additionally, the government wants to set back the age at which women can retire from 64 to 65 years (Informationsstelle AHV/IV, 2021). Another suggestion is to start an AHV-Demography fund. The initiators claim that the ratio of working to retired people changes from 3:1 to 2:1 in the next 20 years. They state that this will pose a problem to the future of the insurance system. Their proposed solution is to take a credit in the height of 300 billion Swiss francs with a duration of 40 years. In the first 30 years, which are free of amortization, reserves should be built and in the following 10 years, the credit should be paid back. By 2060, the fund should be at around 540 billion Swiss francs that can be used for future AHV payments if there is a gross yield of 4% during this time. This should be high enough so that even if the demography dynamics change further, the insurance of the elderlies should be secured (Verein Faire Vorsorge, 2021).

Knowing that it is a current issue, I feel like the Swiss citizens should take action to find a solution to this problem. It is certainly important for our generation that we act now, and not shortly before our retirement. One possible issue is that a lot of the voters are older than our generation and it will not affect them directly, so it is desirable that they still care about the fundamental thought of AHV, which is solidarity and also advocate a sustainable future of the very progressive insurance system of Switzerland. But as of now, the topic is under discussion and it is expected that some adjustment happens in the near future.

References

BFS. (2021). Schweiz-Szenarien. Https://Www.Bfs.Admin.Ch/Bfs/de/Home/Statistiken/Bevoelkerung/Zukuenftige-Entwicklung/Schweiz-Szenarien.Html. https://www.bfs.admin.ch/bfs/de/home/statistiken/bevoelkerung/zukuenftige-entwicklung/schweiz-szenarien.html

Bundesamt für Statistik. (2017). Lebenserwartung. Https://Www.Bfs.Admin.Ch/Bfs/de/Home/Statistiken/Bevoelkerung/Geburten-Todesfaelle/Lebenserwartung.Html. https://www.bfs.admin.ch/bfs/de/home/statistiken/bevoelkerung/geburten-todesfaelle/lebenserwartung.html

Informationsstelle AHV/IV. (2021). Zukunft der AHV. Https://Www.Entwicklung-Ahv.Ch/Alters-Und-Hinterlassenenversicherung/Ahv-Morgen/Zukunft-Der-Ahv/. https://www.entwicklung-ahv.ch/alters-und-hinterlassenenversicherung/ahv-morgen/zukunft-der-ahv/

Informationsstelle AHV/IV. (2022). AHV. https://www.ahv-iv.ch/de/Sozialversicherungen/Alters-und-Hinterlassenenversicherung-AHV/Allgemeines#qa-735

Verein Faire Vorsorge. (2021). Der AHV-Demografie-Fonds. Https://Www.Fairevorsorge.Ch/Der-Ahv-Demografie-Fonds/. https://www.fairevorsorge.ch/der-ahv-demografie-fonds/