When you start a new business, raising money is one of the greatest challenges. How can you do it? In some cases, you might have worked and saved money, or you might have borrowed from friends and family. Sometimes a bank will give you a loan, but this is seldom enough to start a new business, and you have to look elsewhere. Two popular options are crowdfunding and angel investment.

Crowdfunding uses social media to fund your business through the contribution of hundreds or thousands of individuals. Angel investment involves getting money from wealthy individuals or companies who exchange their support for a part of your company

4.1 – Pre-reading tasks

Task A .List two reasons people use social media.

..………………………………………………………………………………………………………………………………………………………………………………………………………………..

Task B. Scan the article to find a definition of · angel Investor.• Why do you think angel is part of the term?

..………………………………………………………………………………………………………………………………………………………………………………………………………………..

Task C . Google, Apple, Starbucks, Kinko’s and The Body Shop are all businesses that were partially funded by angel investors. Choose one o f these companies and describe what sort of angel Investor might have been interested in funding it.

..………………………………………………………………………………………………………………………………………………………………………………………………………………..

Task D . Now read the text below.

Once limited to artists. musicians and filmmakers looking to finance their creative projects, crowdfunding has expanded into the world of entrepreneurship. Crowdfunding taps the power of social networking and allows entrepreneurs to post their elevator pitches and proposed investment terms on crowdfunding websites. such as Profounder, Peerbackers, Kickstarter or lndiegogo, and raise money to fund their ventures from ordinary people who invest as little as $100. Normally, the amount of capital these entrepreneurs seek is small. typically less than $10.000.and the· returns’ they offer investors are mere tokens, such as discount coupons and free product samples. However, some entrepreneurs have raised significantly more money with crowdfunding and offer “real” returns.

Crowdfunding sites typically charge a fee of about 4 per cent to host a funding request, and many proposals fail to attract enough investors to reach their targets. Currently, a proposal before Congress would allow companies to raise up to $2 million in equity financing through crowdfunding. The proposal limits investments to $I 0,000 per year or 10 per cent of the investor’s annual income, whichever is less (Needleman & Loten, 2011).

Angels

After dipping into their own pockets and convincing friends and relatives to invest in their business ventures, many entrepreneurs still find themselves short of the seed capital they need. Frequently, the next stop on the road to business financing is private investors. These private investors (angels) are wealthy individuals, often entrepreneurs themselves, who invest their own money in business start-ups in 25 exchange for equity stakes in the companies. Angel investors have provided much needed capital to entrepreneurs for many years. In 1938, when World War I flying ace Eddie Rickenbacker needed money to launch Eastern Airlines, millionaire Laurance Rockefeller provided it. Alexander Graham Bell, inventor of the telephone. used angel capital to start Bell Telephone in 1877. More recently, companies such as Google, Apple, Starbucks, Kinko’s and The Body Shop relied on angel financing in their early years to finance growth.

In many cases, angels invest in businesses for more than purely economic reasons- for example, because they have a personal interest or experience in a particular industry- and they are willing to put money into companies in the earliest stages, long before venture capital firms and institutional investors jump in. Angel financing, the fastest-growing segment of the small business capital market, is ideal for companies that have outgrown the capacity of investments from friends and family but are still too small to attract the interest of venture capital companies. Angel financing is vital to the nation’s small business sector because it fills this capital gap in which small companies need investments ranging from S100,000 or less to perhaps $5 million or more. For instance, after raising the money to launch Amazon.com from family and friends, Jeff Bezos turned to angels for capital because venture capital firms were not interested in investing in a business start-up. Bezos attracted $1.2 million from a dozen angels before landing $8 million from venture capital firms a year later (Sherrid, 1997).

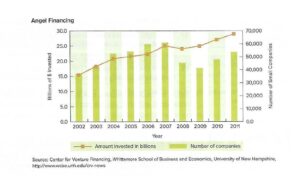

Angels are a primary source of start-up capital for companies in the start-up stage through the growth stage, and their role in financing small businesses is significant. Research at the University of New Hampshire shows that more than 318,000 angels and angel groups invest $22.5 billion a year in 66,000 small companies, most of them in the start-up phase (Sohl, 2012). In short, angels are one of the largest and most important sources of external equity capital for small businesses. Their investments in young companies nearly match those of professional venture capitalists, providing vital capital to eighteen times as many small companies. (602 words)

References

Needleman, S. & Loten, A. (2011, November 1). When friending becomes a source of start-up funds. Wall Street Journal, p. B5.

Sherrid, P. (1997, October 13). Angels of capitalism. U.S. News & World Report, 43-45.

Sohl, J. (2012, April 3). The angel investor market in 2013: The recovery continues. Center for Venture Research, University of New Hampshire.

Scarborough, N.M. (2014.) Essentials of entrepreneurship and small business management (7th ed., pp. 474-476). New York, NY: Pearson.

4.2 – Post-reading task

Task E

Choose the correct phrase to complete each sentence

4.3 – Sentences |

4.4 – Phrases |

|

| 1. Crowdfunding was once limited to | a) angel investors | |

| 2. Profounder, Peerbackers, Kickstarter and lndiegogo are examples of | b) small business | |

| 3. Not finding enough support from crowdfunding makes entrepreneurs seek | c) to start his new business | |

| 4. Crowdfunding websites make a profit by | d)creative projects | |

| 5. Alexander Graham Bell probably didn’t have enough money | e) venture capital companies | |

| 6. In terms of growth, The Body Shop probably needed money to | f) crowdfunding websites | |

| 7. Angel investors provide more funding than crowdfunding sites but less than |

g) open new store | |

| 8. Angel Investors are extremely important to developing … | h charging a fee |